top of page

Get Savvy Blog

Hello, my name is Shirley Schnieders, and my goal is to create a blog that my clients and others will find beneficial. It might be tips and tricks on QuickBooks or Excel or just interesting changes coming to the tax or accounting arenas. You never know, I might also share a joke or two. As always, feel free to get in touch and thanks for stopping by!

Enhancing Growth Through Strategic Financial Analysis and Financial Strategy Analysis

Growing a business is exciting, but it can also be challenging. One of the best ways to ensure your business thrives is by understanding your finances deeply. That’s where financial strategy analysis comes in. It’s not just about numbers; it’s about making smart decisions that fuel growth. I’m here to walk you through how you can use this powerful tool to build a strong financial foundation and reach your goals. Why Financial Strategy Analysis Matters for Your Business When

The Value of Tailored Accounting Solutions for Your Business

When I first started working with small businesses and startups, I quickly realized that no two companies are the same. Each has unique financial needs, goals, and challenges. That’s why tailored accounting solutions are not just a luxury—they’re a necessity. Off-the-shelf accounting services often miss the mark, leaving businesses with generic reports and advice that don’t quite fit their situation. But when you customize your accounting approach, everything changes. You ge

Tailored Financial Solutions for Small Businesses: Your Guide to Startup Financial Services

Starting and growing a small business is an exciting journey. But let’s be honest - managing finances can sometimes feel overwhelming. That’s where tailored financial solutions come in. They help you take control, make smart decisions, and build a strong foundation for your business. Whether you’re a startup, a retailer, wholesaler, or a non-profit without dedicated accounting staff, having the right financial partner can make all the difference. In this post, I’ll walk you t

Mastering Your Financial Year-End: Steps to Ease the Climb

Wrapping up your financial year can feel like a mountain to climb. The pressure to organize, review, and finalize everything before deadlines can overwhelm even the most experienced individuals. But with the right approach, you can turn this challenge into a manageable, even rewarding process. This guide walks you through practical steps to master your financial year-end, helping you avoid last-minute stress and set a strong foundation for the year ahead. Organized financial

Smart Strategies for Effective Financial Planning

When it comes to managing money, having a clear plan is everything. I’ve seen firsthand how smart financial planning can transform a business’s future. Whether you’re running a startup, a small retail shop, or a non-profit, the right strategies can help you build a solid foundation and reach your goals faster. Let’s dive into some practical, effective ways to approach your financial planning with confidence and clarity. Why Planning Financial Strategies Matters Financial plan

Setting Up a Reliable Business Financial System

Starting and growing a business is exciting, but managing your finances can feel overwhelming. I get it! Setting up a reliable financial system is one of the smartest moves you can make early on. It keeps your money organized, helps you make informed decisions, and saves you from headaches down the road. Today, I’m sharing practical financial system setup tips that will help you build a strong foundation for your business finances. Let’s dive in and make this process straigh

Essential Year-End Tax Deductions for Small Businesses and Nonprofits

The clock is ticking on year-end tax planning, and smart expense timing could mean the difference between a painful tax bill and real savings. One strategy many business owners miss? Prepaying certain expenses before December 31. When used correctly, it’s a powerful tool — but only if you understand the rules. Prepaying Expenses to Maximize Deductions Prepaying certain expenses before year-end can be a useful tax strategy, but the impact depends on whether your business uses

Why Effective Inventory Management Drives Business Success

Running a business without a solid grip on your stock can feel like sailing a ship without a compass. You might be moving forward, but are you heading in the right direction? I’ve seen firsthand how mastering efficient stock control strategies can transform a business from chaotic to confident. Whether you’re just starting out or looking to sharpen your operations, understanding how to manage your inventory well is a game-changer. Let’s dive into why effective inventory mana

Overcoming Startup Financial Challenges

Starting a new business is exciting, but it comes with its fair share of challenges. One of the biggest obstacles is managing money wisely. Without a solid financial plan, even the best ideas can struggle to survive. I’ve seen many startups face this head-on, and I want to share some practical tips to help you navigate these financial hurdles with confidence. Understanding Financial Hurdles for Startups When you launch a startup, money can feel like both a lifeline and a puzz

Why Financial Challenges Impact Every Startup

Starting a new business is thrilling! You have a vision, a product or service, and a dream to make it all work. But here’s the truth:...

Unlocking Growth: How Outsourced CFO Services Can Transform Your Business

Running a startup or a small business is exciting, but it can also be overwhelming. Managing finances is one of the biggest challenges....

Unlock the Secrets to a Profitable Summer: Transform Your Business Finances Now

As summer approaches, businesses find a refreshing opportunity for growth. The vibrant energy and excitement of this season can be the...

How AI Can Help You Simplify Your Accounting (Even If You're Not a Tech Expert)

Harnessing AI to Streamline Your Accounting Processes Managing the financial side of a small business or nonprofit can feel...

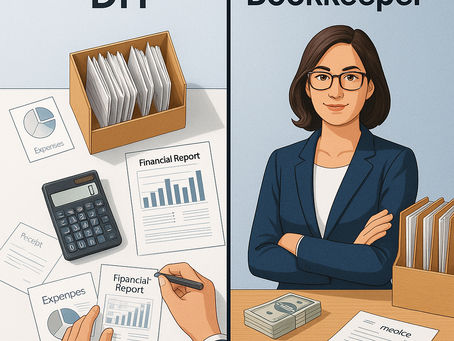

When Should You Stop DIYing Your Books? (Or Just Get Some Help)

The Bookkeeping Crossroads: Do It Yourself or Get Help? When you’re growing a small business, bookkeeping usually starts as one of those...

How to Make Next Year’s Bookkeeping Easier (and Avoid the Year-End Panic)

Make Bookkeeping Easier Does year-end bookkeeping feel like a chaotic mess every year? Scrambling to find receipts, staring at...

How to Conquer the Financial Year-End Maze with Unwavering Enthusiasm

As the financial year draws to a close, many individuals and businesses find themselves navigating through budgets, reports, and looming...

How to Organize Your Business Finances for Year-End and Tax Filing Success

Year End Preparation As the year comes to a close, many business owners find themselves juggling the demands of daily operations while...

Maximize Your Year-End Tax Savings: A Simple Guide to Charitable Donations and Business Expenses

As the year comes to an end, it’s a great time to review your finances and make sure you're getting the most out of your tax deductions....

From Chaos to Clarity: Mastering Receipts for Business Success

In the world of business, maintaining clear and organized records is essential for success. Among the most crucial elements of...

Which Payment Processor is Best for Your Business: A Comparison of Stripe, Square, PayPal, and Authorize.Net

Selecting the right payment processor is like finding the perfect business partner—someone reliable, efficient, and aligned with your...

bottom of page